NEW REPORT:

Migration: Millennials and the wealthy moved in. Most Vermonters stay put

Read the report

Read the report

December 11, 2014, Capitol Plaza Hotel, Montpelier

Opening remarks

Vtdigger asked the members of this panel to propose solutions to the “K-12 education affordability crisis.” I want to focus the limited time in my opening remarks on one question: What crisis?

The so-called crisis is remarkable for the stunning lack of information to confirm that it even exists.

But before you write me off as a “crisis denier” please bear with me for a few minutes.

We’ve had some crises in this state.

Tropical storm Irene was a crisis: people were displaced from their homes; there was millions in property damage; people lost their lives.

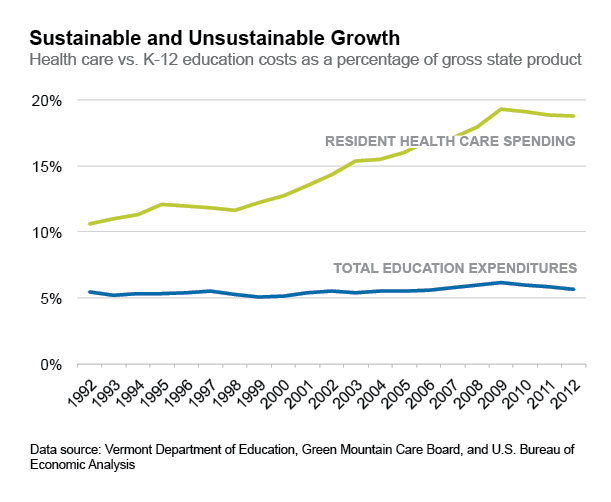

Health care presents an affordability crisis: in 1992 health care expenditures were 10 percent of the VT economy; 20 years later they were nearly 20 percent. That’s the green line in this chart. That sort of spending growth is not sustainable.

But when we look at public education in Vermont, where’s the crisis?

The state has the highest graduation rate in the country and is typically ranked among the top 5 states in student performance on standardized tests. Is it a crisis that our test scores aren’t first in the country?

Voters approve nearly 90 percent of school budgets as they did this past spring. Does 10 percent of budgets failing to pass on the first try this year constitute a crisis?

Education spending consumed the same share of Vermont tax dollars in 2012 as it did 20 years earlier and education spending represents the same share of state personal income over those 20 years. There is certainly no evidence that as a state our spending is beyond our means. About 5.5 to 6 percent of gross state product is pre-K to 12 public education and it’s been that way for 20 years. That’s the blue line in this chart.

It’s a modest investment for one of the main things we do as a society: educate our children. And it’s the picture of sustainable spending, certainly not a crisis.

Some say the problem is rising property taxes. But for whom? Two-thirds of Vermonters pay the school tax on their homes based on their income. In fact, some have argued that we should cut income sensitivity because two-thirds of Vermonters aren’t paying enough. Are the taxes too high on the two-thirds of Vermonters paying based on income now?

Maybe it’s the one-third who are not paying based on income who feel they’re paying too much. Though a Tax Department analysis shows that the median school property taxpayer in each household income category above $100,000 pays a lower percentage of income than those who pay based on income. Those with annual incomes of $1 million or more pay a fraction as a percentage of their incomes in school taxes compared to their lower income neighbors.

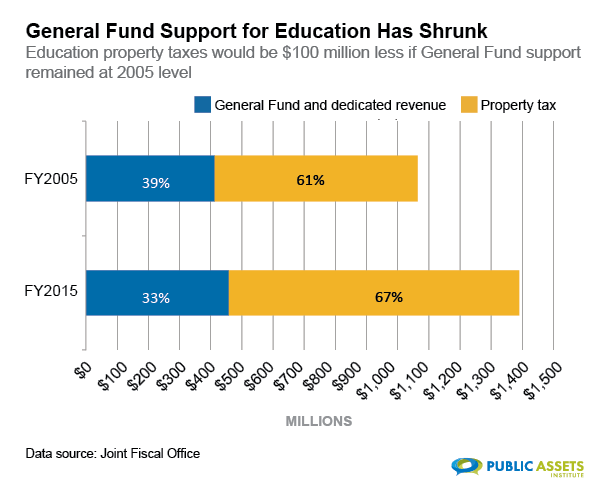

Having said that, school taxes —whether you pay based on income or on the value of property— have been going up. A big contributor to that trend is a drop in the share of school spending covered by the General Fund and dedicated non-property tax revenues like the sales tax. This chart shows that change between 2005 and 2015. In 2005, the General Fund and dedicated revenues paid 39 percent of school expenditures. Ten years later it was down to 31 percent: a $100 million cost shift onto property taxes.

Another factor that may be contributing to the sense of crisis is confusion.

How many of you have seen stories saying that the governor has recommended raising your homestead school property tax rates 2-cents next year? (Show of hands. Nearly everyone raised their hand.)

OK. Here’s some homework.

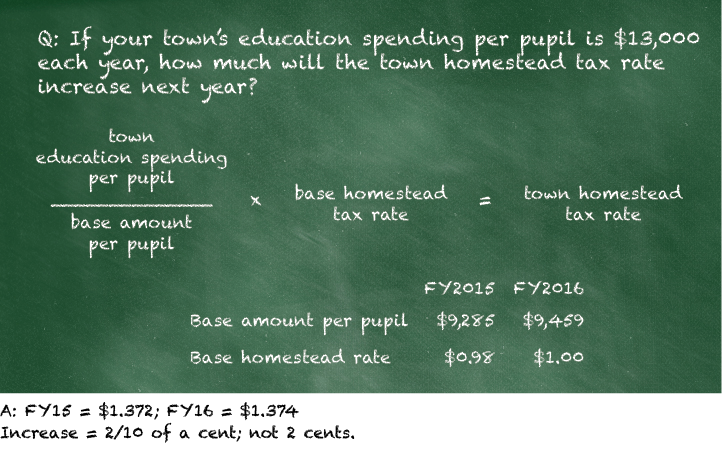

The formula for calculating your homestead school property tax on the fair market value of your property goes like this.

It’s the town education spending per pupil divided by the base amount per pupil times the base homestead tax rate.

The base amount per pupil this year is $9,285 and the base homestead tax rate is $.98. For next year, the governor has proposed a base amount of $9,459 per pupil and a base rate of $1.00.

If your town’s spending were to stay at $13,000 per pupil next year, how much would your town’s homestead school tax rate increase?

Good luck with your homework.

We welcome and publish non-partisan contributions from all points of view provided they are of a reasonable length, pertain to the issues of Public Assets Institute, and abide by the common rules of online etiquette (i.e., avoid inappropriate language and “SCREAMING” (writing in all caps), and demonstrate respect for others).

Paul,

Your personal investment in Act 60/68 blinds you to the reality that Vermont education costs are unsustainable. We spend far too much on pre K-12 education. You can deny that but you fall outside the mainstream that believes its costs are unafforadable.