NEW REPORT:

Migration: Millennials and the wealthy moved in. Most Vermonters stay put

Read the report

Read the report

Vermont has a fairer tax system than most states, but we still have work to do. That’s the message from “Who Pays?” released by the Institute on Taxation and Economic Policy (ITEP) in October.

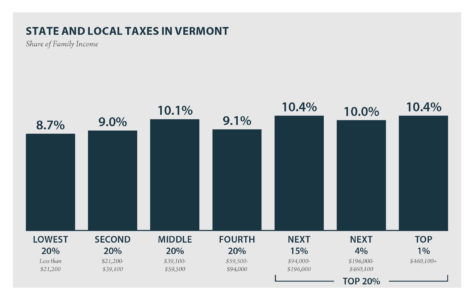

The report looks at how well states distribute taxes based on family incomes. In most states lower-income families pay a higher percentage of their income in state and local taxes than those at the top. That’s the definition of a regressive tax system. Vermont’s is one of the least regressive in the country.

Why is this significant?

Because how Vermont collects taxes can improve our lopsided income distribution or make it worse. The top one percent of Vermont tax filers has an average annual income of over $800,000 while the other 99 percent average about one-sixteenth that amount—about $50,000. 1

When income is out of balance it is not only unfair, it dampens economic growth, reduces upward mobility, and causes poverty. With nearly 70,000 Vermonters living in poverty and the 2017 federal tax cuts tipping the scale more toward those at the top, income definitely is out of balance in Vermont.

While Vermont’s tax system doesn’t shift the income balance even further toward the rich, it doesn’t do much to move it in the other direction either. The chart shows that middle-income families still pay a higher percentage of their incomes in state and local taxes than some with higher incomes.

Comment Policy

We welcome and publish non-partisan contributions from all points of view provided they are of a reasonable length, pertain to the issues of Public Assets Institute, and abide by the common rules of online etiquette (i.e., avoid inappropriate language and “SCREAMING” (writing in all caps), and demonstrate respect for others).