2011 Budget: Cutting the Commitment to Vermonters

By Jack Hoffman (April 2010)

As they wrestle with the recession, Vermont’s elected leaders are backing away from their commitment to citizens. This change in public policy is reflected in their language and in their budgets.

Political leaders this biennium are talking about “reanalyzing and renegotiating the social contract between the government and the people.” 1 They are telling us: “The truth we must all accept is that we can no longer afford the level of services we have come to enjoy.” 2

Recessions challenge leaders’ resolve. And the resolve they are exhibiting during this recession is of a radically different kind from what Vermont saw during the major recession of the early 1990s.

Twenty years ago, Vermont’s governor warned against using budget problems as “an excuse for turning away from our responsibilities.” He was not afraid to say: “We cannot and will not set lower standards for the education of our children, for the health of the population, for assistance to the troubled, jobless, or homeless, or for protection of the environment.” 3 It’s hard to imagine Vermont’s current leaders uttering words like these, much less backing them up with the revenue needed to deliver on those vows.

Twenty years ago, Vermont’s governor warned against using budget problems as “an excuse for turning away from our responsibilities.” He was not afraid to say: “We cannot and will not set lower standards for the education of our children, for the health of the population, for assistance to the troubled, jobless, or homeless, or for protection of the environment.” 3 It’s hard to imagine Vermont’s current leaders uttering words like these, much less backing them up with the revenue needed to deliver on those vows.

During this recession, as the governor and Legislature have been cutting the state budget, they have also been relying heavily on federal funds to keep it in balance, while struggling to meet the increasing demand for services that an economic crisis brings. Up to $450 million in temporary federal funds over three budget years is helping Vermont avoid deeper budget cuts and has largely spared Montpelier from the necessity to increase taxes to maintain the services that all Vermonters use.

But using federal funds is easy. Summoning the political courage to raise revenue is not. In the early 1990s, Vermont’s political leaders did both. They kept their commitment to Vermonters by using additional federal funding and also by initiating substantial increases in state revenues to meet the increased demand for human services.

The test of today’s leaders will come when the extra federal funds are no longer available. The early signs are not good.

A Temporary Reprieve from Washington

Extra federal funding has allowed the Vermont House of Representatives to undo some of the worst human services cuts that Gov. Jim Douglas proposed when he presented his fiscal 2011 budget in January. The House version of the budget passed in late March included about $114 million more in federal funds than the governor had in his proposal. 4 With the additional money, the House eliminated the increase in Medicaid premiums the governor recommended ($1.7 million). 5 It also restored cuts in adult dental services ($1.5 million), in several home- and community-based services ($3.5 million), and in Catamount Health, (3.0 million). 6

Most of the extra federal money—about $62 million—will be new Medicaid funding. Under the American Recovery and Reinvestment Act (ARRA) the federal government is paying a greater share of Medicaid costs. But these enhanced payments were scheduled to expire at the end of December 2010, right in the middle of most states’ fiscal year. Congress is expected to extend the enhanced payments for six months.

The Vermont House version of the budget also uses additional federal money by increasing taxes on health care providers, which are eligible for more matching funds. The House plans to use this additional money to launch an incentive program to encourage providers to improve care and reduce costs. The program also returns some of the new taxes to the providers.

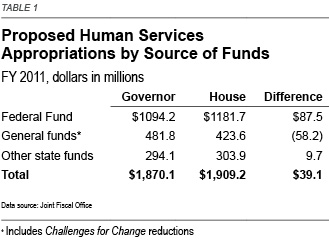

Although the House budget includes about $88 million more in federal funds for the Agency of Human Services than the governor’s, the House increases total spending for the agency by only about $39 million (Table 1). 4 That’s because the House appropriates about $60 million less General Fund money to the agency than the governor did and sets it aside in the “human services caseload reserve.” A future administration and Legislature will decide how to spend those reserves.

Although the House budget includes about $88 million more in federal funds for the Agency of Human Services than the governor’s, the House increases total spending for the agency by only about $39 million (Table 1). 4 That’s because the House appropriates about $60 million less General Fund money to the agency than the governor did and sets it aside in the “human services caseload reserve.” A future administration and Legislature will decide how to spend those reserves.

Human Services in the Crosshairs

The governor has been clear that he sees the Agency of Human Services as one of the keys to solving Vermont’s budget problems. The agency accounts for about 40 percent of General Fund spending. So, faced with a projected $150 million gap in the fiscal 2011 budget, human services is largely where he turned for cuts (Table 2). His plan also proposes to shift costs and redirect revenue. That doesn’t reduce expenditures; it simply pays from a different pocket.

The governor and the Legislature have agreed to try to close about a quarter of the budget gap by following recommendations of a Minnesota consulting firm hired to study efficiency in state government. In its report Challenges for Change, the firm identified eight areas where Vermont could supposedly spend less and still deliver services as good as or better than those now provided. They projected potential savings of $38 million in fiscal 2011 and $72 million in fiscal 2012. 7

In February, the Legislature quickly passed, and the governor signed, a bill directing the administration to go forward with the consultants’ recommendations. In late March, “design teams” began presenting their plans for achieving the new efficiencies.

Like the governor’s cuts, the Challenges for Change savings are concentrated in human services. Of the $38 million in anticipated savings for next year, more than 60 percent—almost $24 million—is supposed to be found in the Department of Corrections, which is part of the agency, and in programs for Vermont families and the elderly. 6 And those are just the General Fund reductions. Vermont could lose another $26 million in federal matching funds if it makes all of the cuts in human services that the consultants suggested. 6

The idea of providing the same or better services for less money has broad support. The Douglas administration came into office eight years ago promising to make state government more effective and efficient and initiated at least three efforts to reform government. 8 The Challenges for Change bill passed with only one opposing vote in the Senate and three in the House. The administration and the Legislature have already assumed that the efficiencies can be achieved, and they have booked the savings in their 2011 budgets. But skeptics worry that the cuts are being made without any assurances of equal or better services.

Including the Challenges for Change savings, the governor proposed nearly $70 million in cuts to human services to close the projected $150 million budget gap for next year. 9 His plan assumed that the federal government would restore $8 million in funding for the Vermont State Hospital in Waterbury. However, the administration learned last month that the hospital was not recertified, so Washington will not provide that $8 million—and that amount will have to be cut unless additional funds are found.

The State Stands Down

Thanks to the federal funding that became available after the governor presented his budget, the House put more money into some of the human services he wanted to cut, especially programs for elderly, disabled, and mentally ill Vermonters.

But while the House budget allocates more money overall for human services than the governor would, the lawmakers are also reducing the commitment of state resources. The House bill appropriates 16 percent less—almost $80 million—for human services from the General Fund than Vermont spent in 2008 before the start of the recession. 10 Meanwhile, the number of people turning to state government for help has gone up, as it always does during recessions.

So far this recession has seen a 20 percent increase in the number of households receiving assistance through Vermont’s Reach Up programs. 11 However, Vermont provides families with only 49 percent of the benefit’s “basic needs allowances,” which have not been adjusted for cost-of-living increases since 2004. 12

The number of Vermonters receiving food stamps is up 63 percent since the start of the recession, due in part to the economic crisis and also to a change in eligibility requirements. 13 Funding for food stamps, which is all federal money, doubled from fiscal 2008 to 2011. 14

Vermont’s tax revenues dropped $170 million between fiscal 2008 and 2010, 15 so it’s good that federal funds are available to help fill the hole. But balancing the state budget is not the same as meeting the state’s responsibilities to Vermonters. Advocates for Vermonters with disabilities, for example, point to a shift from counseling, training, and rehabilitation services to caretaking.

While relief from Washington has allowed Vermont to cut its own spending, the danger going forward is that this reduced state effort will become permanent. The governor has stated repeatedly that he wants a permanent reduction in state spending. The Legislature has been reluctant to cut as deeply as the governor, but legislative leaders are only marginally more willing to maintain services if it means raising taxes.

A Changed View of Government

The response of the Douglas administration and the Legislature to the current recession stands in contrast with that of leaders facing the downturn of the early 1990s. Twenty years ago, a Republican governor and a Legislature controlled by Democrats didn’t try to cut their way out of the crisis. Instead, Gov. Richard Snelling—who also was governor during the severe recession of the early 1980s—advocated a counter-cyclical fiscal policy. Lawmakers agreed to raise taxes—including temporary income tax surcharges on wealthier Vermonters—slow the growth of spending, and run deficits so they could continue to meet the demand for services. When the economy improved, demand declined, and revenues began to increase again—the governor and the legislators agreed that that was the time to cut back on spending and reduce taxes.

Underlying these policies was a philosophy of government: Montpelier believed that a paramount responsibility of the state is to meet the needs of people suffering through an economic crisis.

That earlier recession began in June 1990. 16 Technically, it lasted eight months, but the number of jobs didn’t return to pre-recession levels until the end of 1993. 17 Demand for human services rose, which is the pattern when the economy shrinks and people are thrown out of work. More people turn to the government for heating assistance, food stamps, welfare, and other services. At the same time, the recession left the state short of revenue. The projected shortfall was on the order of $150 million, which represented almost 25 percent of the General Fund budget, a larger percentage than the acknowledged shortfall today. 18

Political leaders of the early 1990s understood the magnitude of the problem because the administration prepared a current services budget. Such a budget estimates the cost of providing all existing services for the coming year, with adjustments for inflation, caseload changes, and other foreseeable factors. It allows policymakers and the public to measure whether the state is meeting its commitments.

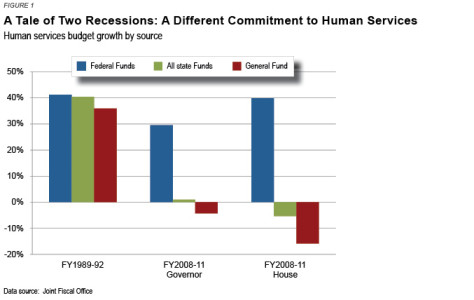

With a handle on both the financial shortfall and Vermonters’ needs, Gov. Snelling and the Legislature responded by making some cuts, but they also increased taxes and ran budget deficits. The long-term plan was to roll back the tax increases after the economy recovered so that the state could be prepared to respond to the next downturn. From fiscal 1989, the year before the recession began, to fiscal 1992, when Vermont was still recovering, the budget for the Vermont Agency of Human Services rose 41 percent. 14 The share of the agency’s budget supported with state tax dollars grew by 40 percent during that period, and the portion funded with federal dollars rose 41 percent (Figure 1).

A Colder Response

Twenty years ago, Montpelier put people first and money second. Today, our leaders’ priorities are the opposite. They no longer view the increased demand for services brought on by the recession as a state obligation—but, rather, as a cost that must be reduced.

Those values are reflected in fiscal policy. In the governor’s latest budget, General Fund spending for human services would be 4 percent less than it was in fiscal 2008. 10 If all state funds are taken into account—the General Fund, Catamount Health, State Health Care Resources, Special Funds, and the Tobacco Fund—the governor’s budget would increase spending for human services just 1 percent over fiscal 2008. 19

The House bill commits even less state money for human services. General Fund spending on human services is 16 percent lower than it was in fiscal 2008; counting all the various state funds, the House budget spends 6 percent less on human services than in 2008. 10

The governor’s budget proposal describes the situation this way: “[W]e cannot deny that the sharp growth in the demand for human services in recent years threatens the overall stability of our budget. Nearly one-third of our population receives services from the [s]tate. Next year, the Medicaid system alone will serve 172,000 Vermonters.” 20

The governor is not lauding the Medicaid system for providing health care to Vermonters who cannot afford it. For him, the size of Vermont’s Medicaid rolls is not the fault of the health care system or a tough economy, but rather the sign of an overly generous social services network. The problem, as he sees it: If Vermont keeps serving its residents as it has in the past, the budget won’t balance without raising taxes. For him, as for the Legislature, additional taxes on anyone, including the wealthiest, are worse than Vermonters going without needed health care or other services.

Vermont’s history, as reflected in its budgets, has been one of making sure people were cared for. For years, when various state rankings have been published, Vermont typically had a median income lower than the national average and per-capita spending on social programs slightly higher than the national average.

That commitment to making Vermont a place that works for everybody is not as strongly evident today. Perhaps it’s the result of 30 years of anti-government rhetoric. Perhaps it’s the fear and anxiety brought on by the recession. We just don’t hear many political leaders speaking about the common good, obligations to fellow citizens, or the importance of public structures.

“We cannot and will not set lower standards for the education of our children, for the health of the population, for assistance to the troubled, jobless or homeless, or for protection of the environment.” When federal stimulus money recedes and Vermont needs to rely more on its own resources, will any of our political leaders speak such words or honor a similar vow? If not, many Vermonters will be even worse off after this recession than they are now.

© 2010 by Public Assets Institute

This research was funded in part by the Annie E. Casey Foundation and the Public Welfare Foundation. We thank them for their support but acknowledge that the findings presented in this report are those of the Public Assets Institute and do not necessarily reflect the opinions of the foundations.

- House Speaker Shap Smith, Stowe Reporter, Jan. 21, 2010.[↩]

- Gov. Jim Douglas, Governor’s Budget Address, Jan. 22, 2009.[↩]

- Gov. Richard Snelling, Inaugural Address, Jan. 10, 1991.[↩]

- Joint Fiscal Office, FY2011 annotated bill (HAC), Mar. 31, 2010.[↩][↩]

- HAC Proposed Changes to Human Services[↩]

- Ibid.[↩][↩][↩]

- Challenges for Change—Results for Vermonters, Summary of Fiscal Impacts[↩]

- Vermont Institute on Government Effectiveness, Vermont Program to Advance Government Efficiency, and Vermont Commission on Government Efficiency.[↩]

- Gov. Jim Douglas, Fiscal Year 2011 Executive Budget Recommendations, Jan. 19, 2010, 3.[↩]

- Challenges for Change[↩][↩][↩]

- Vermont Department of Children and Families, Reach Up caseload count spreadsheet, RU caseload.xls[↩]

- Report to the Vermont Legislature, Evaluation of Reach First and Reach Up, Jan. 1, 2010, 13; www.leg.state.vt.us/reports/2010ExternalReports/254471.pdf[↩]

- Vermont Department of Children and Families, 3SquaresVT Participation Report FY1999-2010 spreadsheet, 3SquaresVT Participation Report (PET).xls.[↩]

- Joint Fiscal Office, FY2011 annotated bill (HAC), Mar. 31, 2010; www.vttransparency.org[↩][↩]

- Kavet, Rockler & Associates, Economic Review and Revenue Forecast Update, January 2010.[↩]

- National Bureau of Economic Research, Business Cycle Expansions and Contractions, www.nber.org/cycles.html[↩]

- Vermont Department of Labor, Vermont NonFarm Employment, seasonally adjusted, 1990-2011.[↩]

- Snelling, op. cit.[↩]

- Ibid. 22.[↩]

- Douglas (2010), 9.[↩]